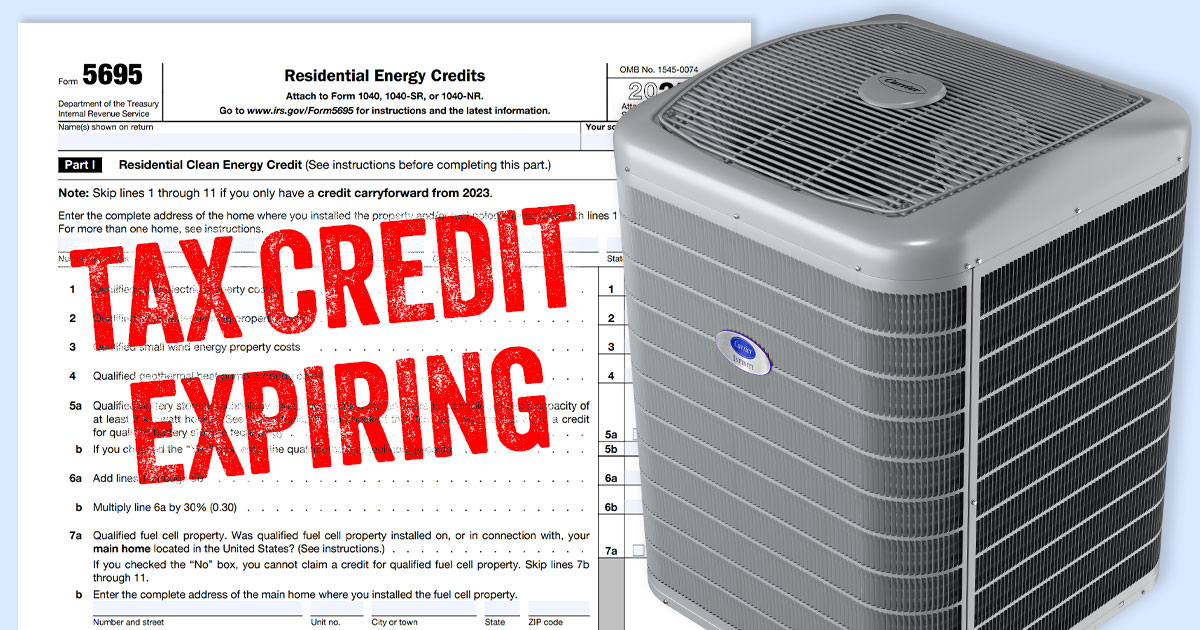

If you’ve been putting off upgrading your heating and cooling system, time is running out to take advantage of significant federal tax savings. The Energy Efficient Home Improvement Credit, which has helped homeowners save hundreds or even thousands of dollars on HVAC upgrades, will expire on December 31, 2025.

What Is the Energy Efficient Home Improvement Credit?

The Energy Efficient Home Improvement Credit is a federal tax incentive designed to encourage homeowners to invest in energy-efficient improvements, including heat pumps, furnaces, and central air conditioners. This HVAC tax credit allows you to claim up to 30% of qualified expenses for upgrading your home’s heating and cooling equipment.

Why Is the Credit Expiring?

The Energy Efficient Home Improvement Credit was originally established to run through 2032, giving homeowners years to plan and budget for HVAC upgrades. However, the One Big Beautiful Bill Act accelerated the expiration date to December 31, 2025, cutting the program short by seven years.

How Much Can You Save?

The credit offers substantial savings depending on the type of HVAC system you install:

Heat Pumps – Up to $2,000 credit

- Electric or natural gas heat pumps

Central Air Conditioners – Up to $600 credit

- Must meet the highest efficiency standards set by the Consortium for Energy Efficiency (CEE)

Furnaces – Up to $600 credit

- Natural gas, propane, or oil furnaces that meet CEE highest efficiency tier requirements

The best part? You can combine these HVAC tax credits in a single tax year if you install multiple qualifying systems.

Who Qualifies for the Credit?

To be eligible for the Energy Efficient Home Improvement Credit, you must meet these requirements:

- Primary Residence: The property must be located in the United States and be your main home where you live most of the year

- Existing Home: The credit applies to existing homes only, not new construction

- Qualified Equipment: Your HVAC system must meet or exceed the CEE highest efficiency tier in effect at the time of installation

- Tax Status: The credit is nonrefundable, meaning it can only offset taxes you owe (you can’t receive a refund for any excess credit)

Landlords and property owners who don’t live in the home cannot claim the credit. If you use your home partly for business, you may still qualify for the full credit if business use is 20% or less.

Carrier: A Name You Can Trust

How to Claim the Credit

Claiming your HVAC tax credit is straightforward. Here’s what you need to do:

- Consult with Your Tax Advisor

This tax credit information is provided for educational purposes and is subject to change. Be sure to consult your tax advisor for eligibility and filing requirements.

- Install Your System Before December 31, 2025

The system must be installed and operational within the tax year you claim the credit. Don’t delay – you’re running out of time! - Keep All Documentation

Save your receipts and obtain manufacturer certification statements from your contractor proving the system meets federal energy efficiency standards. - File IRS Form 5695

Complete IRS Form 5695 (Residential Energy Credits) and include it with your federal tax return for the year the system was installed.

Request an Appointment for a FREE Estimate Now

The Clock Is Ticking

With just a few months remaining until the December 31, 2025 deadline, now is the time to upgrade your HVAC system. Between the substantial tax credits and the long-term energy savings from a high-efficiency system, you could save thousands of dollars – but only if you act fast.

At Air Flow Designs Heating & Air Conditioning, we specialize in installing energy-efficient heating and cooling systems that qualify for federal tax credits. Our experienced technicians can help you:

- Select the right high-efficiency system for your home and budget

- Ensure your new equipment meets all federal efficiency requirements

- Complete installation before the December 31, 2025 deadline

- Provide all necessary documentation for claiming your tax credit

Don’t let these valuable tax savings slip away!

Contact Air Flow Designs today for a free estimate on a new energy-efficient air conditioner, heat pump, or furnace.

Our team is ready to help you maximize your savings while improving your home’s comfort and efficiency.

Disclaimer: Tax credit information is provided for educational purposes and is subject to change. Consult your tax advisor for eligibility and filing requirements. Equipment must be installed by December 31, 2025, to qualify under current federal law. Learn more at IRS.gov and EnergyStar.gov.